A Complete Guide to USDA Construction Loans

When it comes to financing your dream home in a rural or suburban area, many buyers don’t realize they have more options than a traditional mortgage. One of the most flexible choices available is the USDA construction loan. In this post, we’re providing A Complete Guide to USDA Construction Loans so you can understand how they work, the benefits they offer, and whether this unique loan program is right for you.

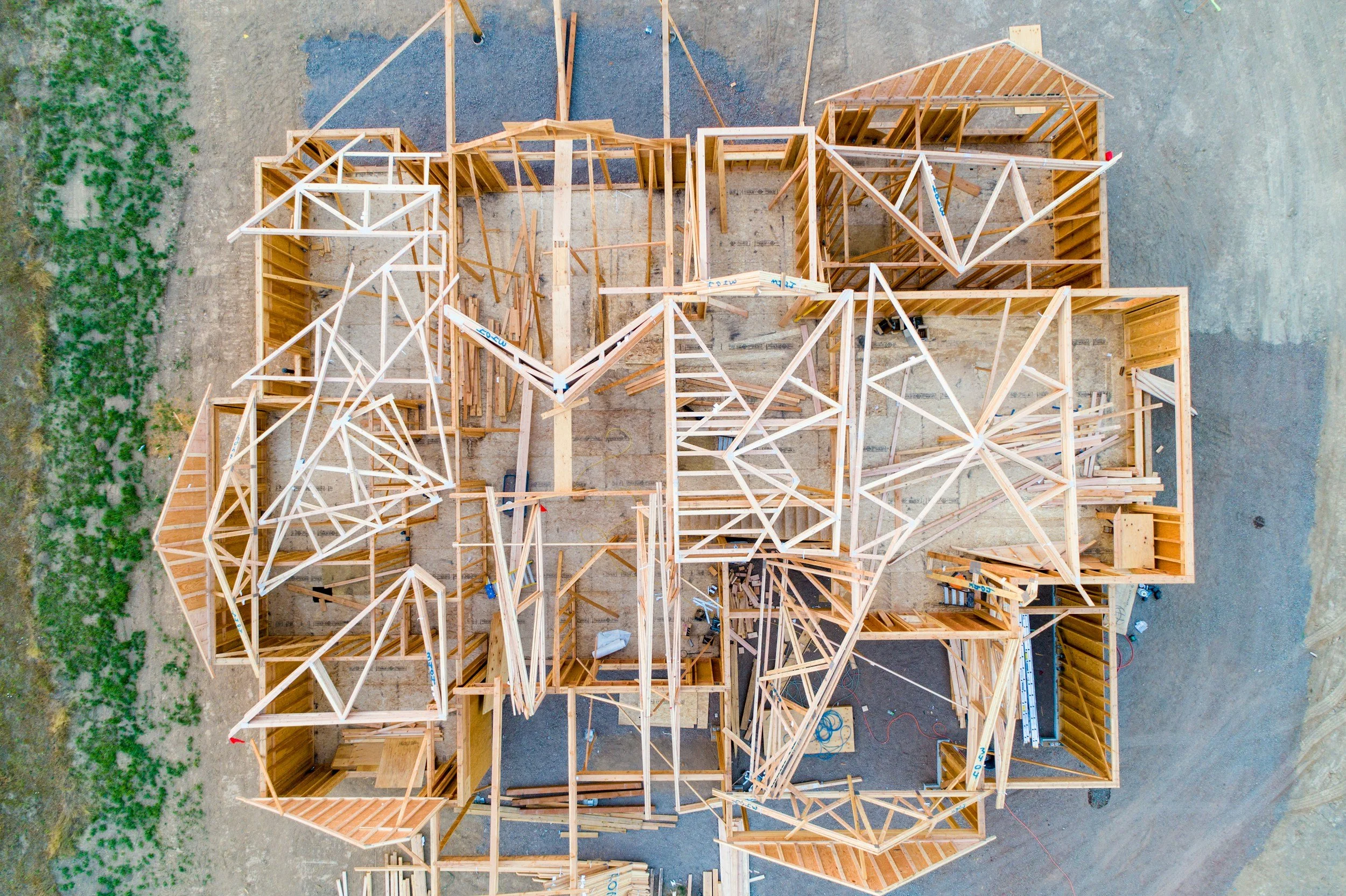

Imagine this is your home that is being built! It’s a dream that isn’t too far from being reality!

What Is a USDA Construction Loan?

A USDA construction loan is a government-backed mortgage program designed to help families build homes in eligible rural and suburban areas. Unlike other types of loans that require multiple closings, this program allows for a single-close construction-to-permanent loan.

That means you can finance the cost of land, construction, and the permanent mortgage all in one streamlined package.

Why Choose a USDA Construction Loan?

There are several advantages that make USDA construction loans stand out from other mortgage options.

No down payment required.

Competitive interest rates compared to conventional loans.

One-time closing simplifies the financing process.

Backed by the U.S. Department of Agriculture, offering additional lender security.

This combination makes it possible for more families to build a home without needing significant upfront savings.

Who Qualifies for a USDA Construction Loan?

Eligibility is a critical part of USDA loans. Here are the main requirements:

Location – The property must be in a USDA-designated rural or suburban area.

Income – Household income must generally be at or below 115% of the median income for the area.

Credit – While USDA is flexible, most lenders look for a credit score of at least 640.

Occupancy – The home must be a primary residence, not a vacation or investment property.

If you meet these requirements, you could be a strong candidate for this program.

How USDA Construction Loans Work

The USDA construction loan process is different from traditional mortgages because it combines construction financing with permanent financing. Here’s how it works:

Loan Application – You apply for a USDA loan through an approved lender.

Approval Process – The lender verifies income, credit, and property eligibility.

Construction Phase – The loan covers costs during the building process, with funds released in stages (called “draws”).

Conversion to Mortgage – Once the home is complete, the construction loan automatically converts into a permanent mortgage with no additional closing required.

This streamlined approach reduces stress and saves borrowers money on closing costs.

Ya, even the cow is interested in USDA construction

Benefits of a Single-Close Loan

One of the biggest advantages of USDA construction loans is the single-close feature. Traditional construction loans often require two separate closings: one for construction financing and another for the permanent mortgage.

With USDA’s single-close structure, you only go through the process once. This eliminates extra fees, duplicate paperwork, and the risk of changing financial circumstances during construction.

Loan Limits and Costs

Unlike some mortgage programs, USDA construction loans don’t have a set loan limit. Instead, the maximum loan amount is based on what you qualify for in terms of income, debt, and repayment ability.

Closing costs can often be rolled into the loan. Additionally, USDA loans require a one-time guarantee fee (usually 1%) and an annual fee (about 0.35% of the loan balance). These fees are much lower than what you’d see with FHA or other government programs.

Eligible Properties

USDA construction loans are flexible when it comes to the type of property. Borrowers can use them to finance:

Brand-new single-family homes.

Manufactured or modular homes.

Certain renovations or tear-down/rebuild projects.

The key is that the home must be a primary residence in an eligible USDA area.

How Do USDA Construction Loans Compare to Other Loan Types?

When considering USDA loans, it’s helpful to compare them to FHA, VA, and conventional construction loans.

FHA Construction Loans: Require a 3.5% down payment and have higher mortgage insurance costs.

VA Construction Loans: Great for veterans, but not available to the general public.

Conventional Construction Loans: Often require large down payments and stricter credit standards.

USDA construction loans stand out for offering no down payment and affordable fees, making them ideal for qualifying rural buyers.

Steps to Apply for a USDA Construction Loan

Applying for a USDA construction loan is a structured process. Here’s a step-by-step guide:

Find an Approved Lender (A.K.A. ME!) – Not all lenders offer USDA construction loans, so choose carefully.

Get Pre-Qualified – Provide your income, credit, and financial details for an initial review. Don’t worry I can help with that!

Select a Builder – The builder must be approved by the lender and meet USDA requirements.

Submit a Full Application – This includes documentation of your finances and the builder’s construction plans.

Close the Loan – Once approved, you’ll close on the loan, and construction funds will be released in phases.

Choosing the Right Builder

Since USDA construction loans require approved builders, it’s important to partner with someone experienced. Builders must be licensed, insured, and financially stable.

Working with the right builder ensures your project stays on schedule and meets all USDA guidelines.

Common Misconceptions About USDA Construction Loans

There are a few myths about USDA loans that often prevent buyers from exploring this option.

“They’re only for farms.” – In reality, USDA loans are for residential homes in rural and suburban areas.

“It takes forever to get approved.” – While USDA loans require extra steps, the timeline is comparable to other government programs.

“You need perfect credit.” – USDA loans are designed to help moderate-income buyers, and credit flexibility is built into the program.

Is a USDA Construction Loan Right for You?

If you want to build a home in a rural or suburban area and avoid a large down payment, a USDA construction loan could be the perfect fit. It provides a streamlined, affordable path to homeownership.

The best way to find out is to speak with me, Mitch Severance and check out our USDA page I can review your eligibility, run the numbers, and guide you through the process.

Final Thoughts

Building a home can feel overwhelming, but with the right financing, it becomes much more manageable. USDA construction loans make it possible to combine land, construction, and mortgage financing into one simple loan with no down payment.

This program is specifically designed to make homeownership more accessible for families in eligible areas. If you’ve been dreaming of building your home, now you know the steps, benefits, and requirements thanks to A Complete Guide to USDA Construction Loans. Fill out the form below to include any questions you may have and it will go straight to my email.

3.5% down payment example for a 30-year fixed-rate FHA loan. total sales price $275,000, down payment $9,625, loan amount $265,375, interest rate 6.91%, Annual Percentage Rate (APR) 6.98%, final principal and interest payment $1,727.

0% down payment example for a 30-year fixed-rate VA loan. Total sales price $275,000, down payment $0, loan amount $275,000, interest rate 5.63%, Annual Percentage Rate (APR) 6.06%, final principal and interest payment $1,602. VA funding fee may apply unless exempt.

Taxes, insurance, and mortgage insurance will be part of the total mortgage payment but are not included in this example. This example is for illustrative purposes only and may or may not be the current interest rate offered. Savings is based on the purchase price and down payment listed above and qualifying credit score. Call for the current rate and full disclosure of current terms.